If you're new here, you may want to subscribe to my RSS feed. Thanks for visiting!

By Daisy Luther

As adults, we’ve all discovered the painful truth that it isn’t Santa Claus paying for the big stack of ever-more-expensive presents under the Christmas tree. It’s us, and we’ve learned the hard way that it’s not just the “most wonderful time of the year.” It’s the most expensive time of the year.

Not only do we have to strive to keep up with our family’s expectations, but we are also the targets of retailers who are doing everything they can to get you to exceed your Christmas budget and spend more than ever. They’re backing up their efforts with science, using surveys and psychological strategies to manipulate customers for more profit.

My family has decided to keep holiday spending ultra-low this year and focus on traditions. (My youngest daughter and I created a book about our plan. You can read more about it here.)

Most people plan to spend more this year than last year.

But we may be in the minority.

Black Friday sales pulled in more shoppers this year than ever before, but they spent less money in stores. Average spending over the shopping weekend was down by about $10 per person, which doesn’t sound like a lot until you realize that there were 154 million shoppers spending $10 less. (source)

But that doesn’t mean the outlook is gloomy. Instead of battling the Black Friday stampedes, more shoppers than ever before took their spending online. Adobe Digital Insights said that online shoppers spent an all-time record high of $3.34 billion on Black Friday and another $3.45 billion on Cyber Monday. (source)

This holiday season, spending is expected to increase by 3.6 percent, to $655.8 billion.

Let’s break this down on a more individual level, because when I read about billions of dollars, I tend to zone out.

According to a survey done by The American Research Group, most Americans will increase holiday gift-giving expenditures by an average of 5% to $929.

But there are other criteria too, that mean more or less average spending. The survey also found:

- The average spending for those saying they plan to make catalog purchases is $1,225.

- The average planned spending by those saying they will make purchases on the Internet is $1,342.

- Shoppers saying they will pay full price [instead of waiting for sales] plan on spending $1,212.

- Those waiting for sales plan on spending $834.

- The average planned spending for shoppers who have already started their holiday shopping is $1,182.

- The average for those who have not started their shopping is $765.

So, if we were to base our budget and timing on the survey, the way to spend the least is to shop in person, look for sales, and hold off on shopping instead of getting an early start.

Retailers are going to do their best to get you to spend more.

Smart retailers are reading the statistics above, too. Especially in brick-and-mortar stores, where sales are down slightly, they’ll be pulling out all the stops to get you to exceed your budget. According to an article from the National Retail Foundation, “Holiday budgets are set in pencil, not stone.” A survey was conducted to see how people could be persuaded to part with more money than they had originally planned on spending.

The survey discussed how customers were persuaded to spend anywhere from $25-$200 beyond their original budgets. Below, you can see the top five reasons people parted with extra money and the percentage of people who said they’d be likely to do so.

- A really good sale or promotion: 51%

- Seeing the perfect gift for someone I didn’t originally plan to buy for: 34%

- Finding something perfect for myself: 27%

- Free shipping with no minimum threshold: 27%

- Needing additional items for last-minute parties: 17%

The article also suggests that convenience, like easy returns and delivery, can make people more likely to spend, particularly people over 65. And finally, expert salespeople can persuade people to purchase more expensive versions of items they are seeking, or even things that were never on the shopping list to begin with.

The NRF concludes, “Shoppers can be convinced to spend more than they originally budgeted for, but may need a little convincing or inspiration. Retailers can try these tactics to earn more of those spontaneous sales.”

The most important thing you can do is make a Christmas budget and stick to it.

As you can see, retailers and marketers strategize all year long to figure out how to part you from your money. If you are aiming for a simpler holiday season, having financial difficulties this year, or just want to be able to face the New Year without holiday debt looming over your head, it’s essential that you understand the ways they’re trying to manipulate you.

The most important thing you can do is to set a budget – in cash – and stick to it. Below, you’ll find an excerpt from our new book, “Have Yourself a Thrifty Little Christmas and a Debt-Free New Year.” The excerpt discusses how to set a budget that won’t impoverish your family, and most importantly, how to adhere to it.

First of all, you have to create a budget. It’s easy if you have been putting aside money and saving up for the big event. Otherwise, see what amount you can spare, and then stick to it. Never, never, never put Christmas gifts on a credit card! I can think of no more horrible way to start a new year than opening astronomical bills that are incurring 28% interest.

Here are a few tips to help you stick to the budget:

- Figure out what you can truly afford.

Many of us don’t have the means for a financial free-for-all with the justification that “Christmas only comes once a year!” Christmas might just come once, but those credit card bills will keep on coming, every single month until they’re paid off, accumulating interest long after the gift has lost its charm. Make sure you pay your bills first, put aside a little money for an unexpected emergency, and have a stocked pantry of food before you go and spend hundreds or even thousands of dollars to fuel a 15-minute paper-tearing frenzy on Christmas morning.

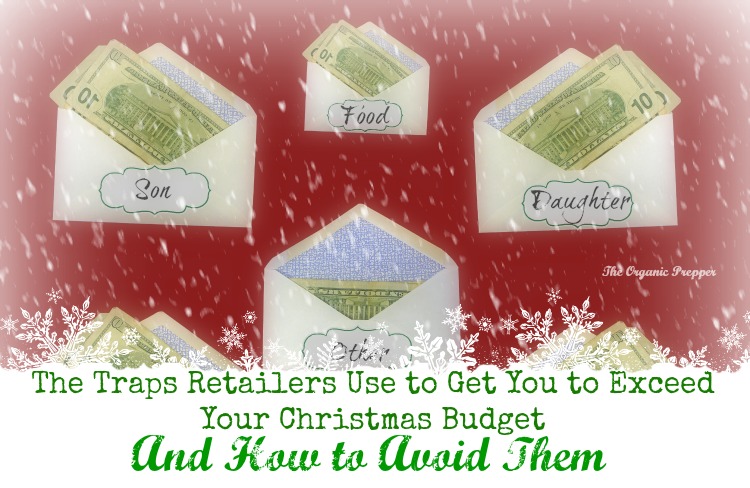

- Use the envelope method.

To do this, write the names of your gift recipients on envelopes. You can also include envelopes for groceries, decorations, and charitable giving. Into each envelope, place the designated amount of cash you intend to spend on each person or item. When you purchase something, place the receipt and the change into the envelope from whence the money came. The most important thing: When the money is gone, it’s gone! You don’t get to top it up or buy one more thing. This is your limit.

- Let the kids know what to expect.

Ever since my kids were old enough to understand it, I’ve told them what the Christmas gift budget was for that particular year. If it is $50 each or $200 each, they have known in advance and have made their lists accordingly.

I’ve been told that this is “mean” and it “takes the magic out of Christmas.” Honestly, I think it is kinder to let them know what to expect, particularly if it’s a tight year, than to allow them to expect a room full of expensive presents that just magically appeared. The girls nearly always get what they want for Christmas because they keep their wishes within a budget. They don’t ask for iPads and XBoxes because those are purchases that exceed the amount we are spending. Because they know what to expect, they’ve never been disappointed on Christmas morning, and I’ve never been stressed and worried that they’ll be unhappy.

What are your frugal Christmas budget tips?

Do you consider the holidays a free-for-all where spending is concerned? How do you keep spending under control? Share your favorite tips in the comments below.

2 Responses

I use the envelope method. I save money from every payday. I put it aside. Then I use it for Christmas gifts. I start looking around September and throughout the fall. I look for sales, sometimes I make things, I go to TJ Maxx, Home Goods and other discount stores. I find better deals and quality there. Sometimes my adult children ask for food they can’t afford or other practical things. I can start looking earlier. There is a temptation to spend more but I try to spend in my budget. I will spend more if it is truly needed or the person is in dire straits. I am on a limited budget. I once bought my son a Sonic care toothbrush. I figured it was worth it to keep him from having cavities or crowns. He is a very hard worker and doesn’t make much money. I think keeping a list and listening to people talk all through out the year. They give you clues to things they like.

We have a lot of grandkids and want to get something unique for each of them. It can be tough to remember who got what for birthday and for Christmas. I created an Excel spread sheet with all the names on it, we set a budget and I keep track of what I bought for each person. This helped me more than anything else.