If you're new here, you may want to subscribe to my RSS feed. Thanks for visiting!

By the author of Be Ready for Anything and the online course Bloom Where You’re Planted

If you’ve noticed that it takes a lot more money to live the middle-class American Dream than it used to, you aren’t alone. Buying a house, saving for retirement, and putting your kids through college while living comfortably is a whole lot harder than it once was. Being part of the middle class sure isn’t what it used to be.

Despite the rosy outlook on employment numbers, things have become incredibly difficult for many families. They’re deeply in debt, living paycheck to paycheck, and without an emergency fund. Let’s take a look at what the media is saying about the middle class.

First of all, what IS “middle class”?

There are many different definitions of middle class, and a lot of it depends on where you live. “Easy,” you may be thinking. “Just live somewhere with a lower cost of living.” Unfortunately, it isn’t that easy, because when you move to an area with a lower cost of living, you’re likely to get paid less for your occupation.

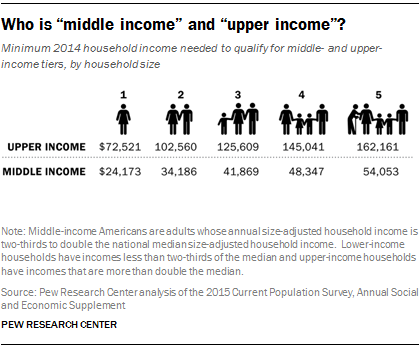

Once upon a time, the middle class was the largest group of Americans. Now, according to the Pew Research Group, it is closely matched by people in the low-income class and the high-income class. The image below shows the stats for 2014.

Photo Credit: Pew Research Group

According to Quentin Fottrell, the personal finance editor for MarketWatch, “middle class” is tough to define:

There is no universal definition of the middle class. The Pew Research Center often uses the middle wealth quintile, the middle 20% of Americans’ income and wealth. Other economists have said it’s defined as making 50% above or below the median annual income. Most Americans regard a college education as a critical component to becoming middle class. Some 71% of people with a college degree consider themselves middle class versus just 58% of people with a high school diploma or less, according to a 2012 survey by Gallup. And yet college graduates in 2017 are shouldering $1.3 trillion in student debt.

Previous studies suggest those who identify as middle class as higher than 50%, but also indicates that the middle class is shrinking. Those who identify as middle class has fallen to 59% in 2010 from 62% in 1991, according to a separate report by the Pew Research Center, a nonprofit think tank in Washington, D.C. (source)

Other sources cite variables like savings, net worth, debt, and spending to determine whether a family is “middle class.”

These two calculators will help you compare your income to others in your area:

For the purposes of this article, we’re going to go with Pew’s definition of the middle wealth quintile.

The middle class is shrinking

The middle class is getting smaller. According to an article on Quartz:

Pew defines middle earners as anyone who earns between two-thirds and twice the median household income in a given year. In 2014, this included a three-person household earning between $42,000 to $126,000 per year. In 1971, 61% of households were middle earners by this standard. By 2015, only 50% were. (source)

The Pew Group said:

After more than four decades of serving as the nation’s economic majority, the American middle class is now matched in number by those in the economic tiers above and below it. In early 2015, 120.8 million adults were in middle-income households, compared with 121.3 million in lower- and upper-income households combined, a demographic shift that could signal a tipping point, according to a new Pew Research Center analysis of government data. (source)

Both of the above articles state that more people are getting pushed into the higher income class than are sliding into the lower income class, which sounds great, initially. But when you look at it more closely, those in the middle class are far less wealthy than they used to be:

…middle-income Americans have fallen further behind financially in the new century. In 2014, the median income of these households was 4% less than in 2000. Moreover, because of the housing market crisis and the Great Recession of 2007-09, their median wealth (assets minus debts) fell by 28% from 2001 to 2013…

…The gaps in income and wealth between middle- and upper-income households widened substantially in the past three to four decades. As noted, one result is that the share of U.S. aggregate household income held by upper-income households climbed sharply, from 29% in 1970 to 49% in 2014. More recently, upper-income families, which had three times as much wealth as middle-income families in 1983, more than doubled the wealth gap; by 2013, they had seven times as much wealth as middle-income families. (source)

It’s getting harder and harder to thrive on a middle-class income

The middle class isn’t what it used to be. Once the “American Dream,”middle-class families are struggling for several reasons. Despite their incomes, they owe more and have saved less than ever before. If you can dig through the politically charged introduction and get to the statistics in this NY Mag article, you’ll find the following:

The percentage of families with more debt than savings is higher now than at any point since 1962, while the median American family’s net worth is lower than it’s been in nearly a quarter-century…

…So, this is what a “good” economy now looks like in the United States: shrinking household wealth; soaring middle-class debt; wage growth that can’t keep pace with the rising costs of housing, healthcare, and higher education; job growth concentrated in part-time positions; widespread retirement insecurity; and more wealth-less households than America has seen for 56 years. (source)

Having more debt than savings is called “negative wealth.” One-fifth of American households fall into this category. Of course, $1 trillion in credit-card debt and $1.4 trillion in student loan debt has to take a toll eventually, right?

Then there’s the ridiculous cost of healthcare in our country. (I recently had my own bad experience with healthcare costs.) Those who are on the upper end of the middle class are hit with premiums well into the thousands of dollars per month for far less coverage than they had previously.

“Health-care spending is growing at an unsustainable rate. Insurance and medical costs are draining the incomes of the middle class—tens of millions of people who earn too much to qualify for government-subsidized coverage, but not so much that they don’t feel the bite of medical bills…Health premiums and out-of-pocket costs wiped out most of the real income gains for a median family from 1999 to 2011, according to an analysis published on the blog of the journal Health Affairs in 2013.” (source)

Finally, Americans don’t have much in the way of an emergency fund. A recent study found that a whopping 47% of us would be unable to cover an unexpected bill of only $400. The middle class – and often even the upper middle class – are living paycheck to paycheck, and not always through poor handling of money.

Where the great jobs are, folks want to make $300,000-400,000 to live a middle-class lifestyle.

Lots of young people go deeply into debt for an education that will (hopefully) land them a job in Silicon Valley, New York City, or some other metropolitan area. After all, that’s where the jobs that start you off at $80,000 a year are, right?

Unfortunately, these are also the places in which the cost of living is completely out of reach for those with middle-class incomes, making it so that to be “middle class,” people feel as though they need to earn anywhere from $300,000-400,000 per year. This article pinpoints the actual amount of money you’d need to make in 25 different metropolitan areas to live a middle-class lifestyle.

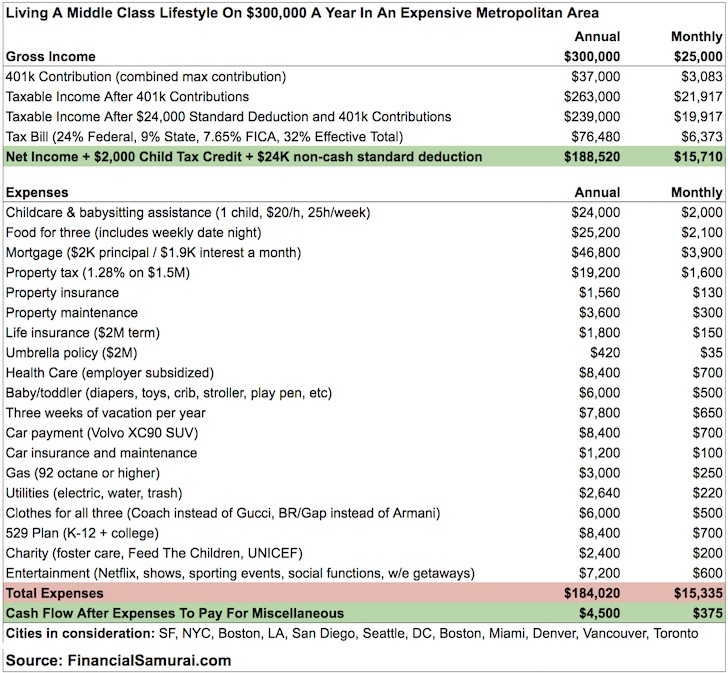

While there’s a big difference between these amounts and the amounts that statistics show are needed, the stats aren’t showing everything. Sam Dogen wrote an article about why you need to earn more:

Let me tell you a sad story: In order to comfortably raise a family in an expensive coastal city like San Francisco or New York, you’ve got to make at least $300,000 a year. You can certainly raise a family earning less as many do, but it won’t be easy if your goal is to save for retirement, save for your child’s education, own your own home instead of rent and actually retire by a reasonable age. (source)

Here’s the budget he put together. If you read the article and look at his review of the expenses, they aren’t as out of whack as they might sound to those of us who live outside of the major metro areas.

While I can’t actually imagine making that kind of money every year, neither can I imagine facing those kinds of expenses. When your base costs are that high, even hardcore frugality can’t save you.

What’s a middle-class family to do?

It’s essential to watch the trends and be ready if things come tumbling down. Here are the things on which you should focus:

- Building an emergency fund – you don’t want to be one of those people who can’t handle a $400 emergency, right?

- Reducing your fixed expenses – this will help you through the rough times

- Building a stockpile – this will cut your costs to the bare minimum during bad times

- Paying off debt – this will help you live within your means

It’s essential to pay attention to what is going on in the economy. Jose, our writer from Venezuela, wrote of numerous warning signs that should have told him that a financial crisis was drawing near. If you want to keep up to date with what is happening, subscribe to my newsletter here.

Finally, maybe it’s time to take a look at the lifestyle for which you yearn. Maybe you need to focus on simplicity. Maybe you don’t need to keep up with the Joneses. Maybe, after some adjustment, you’ll find that you are happier without the stress of competing for that middle-class lifestyle.

Figure out your priorities. Would you rather have a big house or travel the world? Would you prefer to put your kids through school debt-free or have a new car every other year? Most of us can’t do both.

The only way to be different from those families who are struggling to pay their $24,650 in monthly expenses is to live differently than they do. Being part of the middle class isn’t what it used to be. It doesn’t take a financial expert to see that the US economy, despite the optimism from the White House, is going to continue to hit most of us hard. Now is the time to make the changes before they’re forced on you.

Good articles Daisy…But PLEASE Extract those G –O—O—N goggles your wearing in your bottom picture….It’s like looking at the Headlights on a 1934 Ford Pick-up…..

It is a very good article & I rather like the glasses (goggles).

Buy more Bitcoin.

Bitcoin is only as good as the internet that is up and running. I prefer something I can hold in my hand like silver. Gold is to expensive. Remember gold is the medium of Kings, silver is the medium of gentlemen and barter is the medium of the pheasants.

Good article.

Put yourself on a budget, pay off the debt, and try to live at or even better, below your means.

Both husband and wife must work full time, not raise kids, live in a modest house try to live in a town/city that is affordable over all including taxes, housing. Saving the max for retirement. Raising kids for the most part best left to the wealthier couples so the wife can stay home, maybe work part time in a home business. One child costs 300,000 to raise till 18, and now days, kids don’t work their way thru college like my generation did or my parents did. This has been going on for sometime, so unless the breadwinner is making a high salary, conservative lifestyles where wife must work and not raise kids makes sense. Using mass transit (like I had to when he took the car) in the 70’s, until we could afford two cars, is an option. Both of us had blue collar jobs, saved, took earlier retirement several years ago,, remained child free (while friends got food stamps) during the ’80’s too, when inflation was going crazy. Financial stress causes many divorces.

I’m Tired of CRAP articles trying to make poor people feel guilty.

POOR People pay sales taxes, property taxes, fees, and all sorts of other government crap.

The 1% has multiple MANSIONS and other properties and if they want these WARS that (supposedly) protect THEIR property, they better PAY for the War Equipment because THEY sure as hell do NOT SERVE IN UNIFORM.

xxxxxxxxxxxxxxxxx

Time for the 1% and Corporations to contribute PROPORTIONATELY to the National Defense.

The Workers give their LIVES get maimed and killed.

The Workers Pay high taxes for ONE house with a MORTGAGE.

The !% and Corporations have multiple houses, pay ever decreasing taxes and enjoy the FAT of the land.

PFIZER wants to leave?

Pfizer would not even EXIST without the ultimate sacrifices of countless Workers …….

Pfizer can leave okay, empty handed, with It’s PAPERS of INCORPORATION and nothing else.

ALL else is surrendered to paying the WAR COSTS that kept Pfizer alive.

And no more TAX DODGING “trusts” and “foundations” where they still CONTROL their money, they just don’t PAY TAXES.

Please explain how my “CRAP” article is trying to make poor people feel guilty? I’m not quite following your logic there.

@Daisy, your article is not crap. The notion that it is trying to make poor people feel like crap is, well, crap.

Between the wife and I, we make 6 figures.

And, as you point out, it is still not easy to make it in the “middle class.”

Personally I think the Pew Research Center definition for Upper income should be adjusted to Middle income.

That would be a more realistic reflection of reality.

Despite our income, the wife and I are on a strict budget. We put 20% into savings/retirement. We fore go many of the luxuries the one gentleman has listed (date night once a week, 3 week vacations). We use the gardens and small livestock to reduce our grocery bill.

Fiscally, we are very conservative. Nor do we point to external entities as causation of our woes. We are not victims.

I’m confused by the above comment. I read the article and didn’t get the impression that ithis good article was trying to make poor people feel guilty. It was explaining what is happening / has happened to the middle class in the USA. Kind regards.

Seven skinny cows eating seven FAT cows …… is Anyone CONSERVATIVE left in America?

Trump is what the FAT cows leave behind ………

This year the BANKSTERS take $276.2 billion from you as “interest” on just the National Debt. Here is the Debt Clock – http://www.usdebtclock.org/ — you can watch it real time. This is at a time of historically low rates ….. what happens when rates go up? Trump is INCREASING the debt, and thus the interest payments at a time of increasing interest rates. You pay your debts off when times are good ….. remember the 7 skinny cows eating the 7 fat cows???

Keep digging — http://investmentwatchblog.com/credit-card-payments-and-subprime-auto-defaults-are-soaring-holiday-spending-set-to-hit-12-year-high-thanks-to-debt/

Get some FACTS straight …. the DOW, NASDAQ, & S&P are hitting all time highs. Unemployment is supposed to be at all time LOWS. We are supposedly having a glorious upsurge in the economy, If we do not pay off the debt NOW when will we? All this glorious economic news and we still have DEFICITS?! Why do you have to “cut taxes for the already rich” so they will supposedly be inspired to create more jobs …… when everybody is supposedly employed???!! And the true job creation is proven to be by Small Business and financed by Middle Class spending, NOT by millionaires.

“the tax cut is an exercise in willful blindness. The same no doubt could be said for the 1981 Reagan tax cuts, which predictably led to unprecedented deficits when Republicans as well as Democrats balked at making offsetting budget cuts. Yet at the time a whole band of officials in the White House and the Congress clamored, in some cases desperately, for such reductions. They accepted a realm of objective reality that existed separately from their own wishes. But in 2017, when the Congressional Budget Office and other neutral arbiters concluded that the tax cuts would not begin to pay for themselves, the White House and congressional leaders simply dismissed the forecasts as too gloomy.” http://www.zerohedge.com/news/2017-12-25/us-has-reached-last-stage-collapse

“Alas, all you suckers out there are , like this writer, a few paychecks away from financial uncertainty. The less than one thousand dollars extra per year that this bill will throw you is nothing compared to the mega millions the super rich and the large corporations will see added to their spreadsheets. https://www.globalresearch.ca/must-be-the-season-of-the-rich/5623913

Whilst the elite owns most of the assets, ordinary people own the debt. Not just their own debt but also the public debt burden which irresponsible governments have built up, including unfunded liabilities such as pension and medical care. And when the financial system fails, ordinary people will suffer the most.

“USA is ‘out of whack’ with the rest of the world” ???? USA is fighting and PAYING for most of the WARS. Make those other countries pay for the wars and watch their tax rates rise. Better yet …. STOP the wars we are in. We are losing them anyway ……………

We should be raising taxes. If these Billionaires had to pay a proportionate amount equal to the benefit they derive from Us protecting Their money, property, LIVES …….. they would take an interest in getting a GOOD government not just one that serves their immediate interests …. They would insist on ending corruption and waste and balancing the books. People whine there is no such thing as “fair” taxes ,,,,, but there is . The Workers pay with blood & money for ONE house with a mortgage to the BANKSTERS ….. counting all they pay for state, local, sales, federal taxes 1/3 of their gross. The Billionaires whine they need tax cuts “to create jobs” and NEVER SERVE in uniform so they never get PTSD, amputations, maimed or die.

TAKE 70% of their gross because they own multiple homes with NO mortgages.

It is past time these Billionaires & mega-corporations PAY for the wars from which they profit and which protect them. Either PAY for the wars, or we put your Boards of Directors in the Front Lines to BLEED with us working stiffs. You want to move your corporation, OUR JOBS, to another country to dodge taxes here? So WE have to pay for your wars? Over YOUR DEAD BODIES. The U.S. has intervened militarily and covertly in so many nations it is impossible to recount them all but in every case the American military is protecting some investments of value to American corporations, or a strategic position or both.

Those who benefit the most should contribute a proportionate share.

Amazing that all these leftwing tech billionaires do not want to share THEIR wealth. They always talk left wing “communalism” but they clutch their money like it is life itself ….Even when they “give” charity it is through THEIR trusts &foundations that THEY control and reapTAX BENEFITS FROM. Even though They are always eager to spread YOUR money around……

Time for the 1% to contribute PROPORTIONALLY to the War Efforts. Much is expected from those to whom much is given.

Some of our Troops give ALL, or are maimed for life,and the 1% balks at giving MONEY when they have so much?!

Cut taxes for the “Rich” so they will invest their money in creating more jobs? By that logic giving ALL your money to the Rich would make Everyone rich. Humanity already tried that. It was called FEUDALISM, a primitive form of COMMUNISM.

LISTEN to what these neocon PSEUDO-capitalists are saying:

“TAKE from the POOR and GIVE to the RICH”

“FROM each according to their ABILITY, TO each according to their NEED. The POOR have the ABILITY to be squeezed for more taxes …….. and the Rich NEED more money …… to create jobs”???????.

This is INSANITY, this is C-O-M-M-U-N-I-S-M by a different name.

MAKE ZUCKerberg and these other Billionaires want to flood the labor pool and drive down YOUR wages with cheap illegals & invaders ….. . As it is, YOU pay to bring in and train YOUR replacements.

The rich “Nobles” paid NO taxes and they created LOTS of jobs for the SERFS and PEASANTS………building CASTLES and making life better for the RICH-NOBILITY. Work and Taxes was all the Serfs knew. Where do the heroic figures of Robin Hood and William Tell spring from if not resistance to this inane idea? Seing this extremist idea dragged out of the muck of history proves to me that our Nation has truly been DUMBED DOWN and Public Schools need to be upgraded and intensified.

Quit living in Never-Never Land where Wars are not paid for. The Founding Fathers of America didn’t. The Founding Fathers were rich, but they knew it was their CIVIC DUTY to contribute. It was called LEADERSHIP. They personally “raised” entire companies of men for the war. That means THEY PAID FOR THEM. Not like today when the YELLOW-BELLIED-DRAFT-DODGING Neocan WAR PROFITEERS beat the drums for endless war, and insist that YOU pay for it, while they reap profit off Defense Stocks. It is REALITY CHECK time America. Make those who pound the War Drums, GO TO THE WAR.

All very true, but rather optimistic aren’t you, Samual? It is even WORSE than you describe in reality, but nobody believes me when I try to explain it. They have been MORE than dumbed down in school. They are being outright lied to on a daily basis about everything. In fact, they learn more lies than truths, and that is a FACT!

Epic rant, lotta truth

Good article, Daisy. We live on a low end middle class salary, but we live in a cheap apartment, don’t have cable TV (have you SEEN how expensive those movie channels are?), aren’t raising kids, own our car, buy cheap clothes, and don’t go on vacations. Even then it can be a challenge at times.

Redbranch: Amen! us too (70’s 80’s early 90’s era) No cable TV even now-not a TV freak. But we grew old, got pay raises and still lived within our means, took short vacations (already served military he was overseas six times, me once) travelling to beaches, mts in Tenn., Ga. etc we are now travelled out, living on SS, ret. army,401k and muni bond interest. You’ll get older and end up w/nest egg hopefully an inheritance when parents pass on. (It all adds up) We drive Kia’s and live the way we want, free of debt. Raising kids is a bummer for life folks tell me, they want $$$ even up in their 40’s from 70 something parents.

I wish I took home that dude’s 401 k contribution each month……300k a year…. I wouldn’t know what to do with that..

Most people think my husband and I are poor. We don’t follow the normal mold of upper middle class. We don’t buy new cars or furniture. I buy off craigslist used furniture, household items, animals, cars, etc. I normally wear jeans and don’t dress up nor follow fashion. I don’t wear makeup. I don’t have a TV set or cable or Netflix. My one true luxury is our internet satellite. It is also our VOIP. Our cell phone is a pay as you go and is only used when we travel from home. That is $2 on the days we use it and no contract. I spent less than $30 for the phone. Cell phone reception does not work on our property. We live off grid and have our own well. I haven’t been to a movie theater in years. I rather spend the money on a class learning cheese making, rigid heddle, etc. or a used book. However I could buy new if I wanted to. I just budget for it when there is something I need new like my new speed queen washing machine. We have a spread sheet. Everything we buy (even a cup of coffee or candy bar) is put in the spread sheet. We use it to see what our expenses are and evaluate & estimate what we are going to spend in each category for the next month. To include gifts and tithing. We have a land payment (which we pay extra on the principle), but we are building our house slowly out of pocket. It is safe to say we don’t keep up with the Jones. Nor are there any fights over money. What we have and our expenses are in black in white for both us to see. We discuss each expense and don’t hide any expenditures. I realize we are not the norm.

thank George Soros, David Rockefeller, and the other globalists for transferring our factories and our wealth to China, Brazil, Mexico, and India. This is the biggest transfer of wealth in history, even bigger than the wealth that was transferred to OPEC for their oil. Refineries bring in heavy sour crude from Brazil, Venezuela, and Mexico in exchange for inflated prices. The globalists are more concerned about the middle class in China than they are about the middle class in the US. All of this so you can buy goods at a discount price at Walmart, Target, or Sam’s. The largest employer in most states these days is Walmart. The next largest employer is the federal government. These are not manufacturing jobs. We finally have a President in office that sees that this might be a problem. He is rich enough and powerful enough to stand up to the billionaire globalists. And the Dems & Libs HATE him for it. Then they complain that their precious daughter, who just graduated from a private university with an expensive liberal arts degree in Womens’ Studies, can’t find a high paying job with benefits and retirement. Somehow this too is all Trump’s fault. Go figure.

this is all newspeak. “class” does not equal “income level” but conflating and confusing the two divides the working class. If you receive a salary or wage, you are working class. if you own your own business you are middle class. If you live off of your capital investments you are upper class. In post-war USA the working class, protected from competition from abroad (Industrial Europe and Japan destroyed) and at home (low-wage immigration being severely limited until 1965) and with thriving unions giving the working class some political and economic heft, working men were able to live like the middle-class and were led to believe they had indeed risen above the “lower” class. All a card game. I’m not a socialist, but if Americans don’t read and understand Marx’ theories they will continue to be conned.