(Psst: The FTC wants me to remind you that this website contains affiliate links. That means if you make a purchase from a link you click on, I might receive a small commission. This does not increase the price you’ll pay for that item nor does it decrease the awesomeness of the item. ~ Daisy)

The Snowball Method is a snazzy little trick that can help you pay off debt as quickly and efficiently as possible.

Many Americans owe so much money that they have no idea how they’ll ever manage to pay it off. And to make matters even worse, 35% of these indebted Americans owe money that is past due by 180 days or more.

If you’re in debt, there is a way to dig your way out.

The best book I ever read about paying off debt is The Total Money Makeover, by Dave Ramsey. You may be able to find it at your local library, but if you can’t, I suggest you buy it. Even if you are struggling financially, I recommend scrimping someplace so you can manage to purchase the book if you are trying to pay off debt and get back on your feet.

Dave recommends something called “the Snowball Method” for repaying debt quickly. Imagine a snowball at the top of a hill. As you roll the snowball, you pick up more snow, and the snowball gets bigger. By the time it’s at the bottom of the hill, it’s huge. You can do the same thing with debt by paying off the smallest bill first, then applying what you’d normally pay on that lowest bill to the next bill. Continue adding the minimum payment for each paid-off bill to the next largest one until all of your debt is repaid.

This method assumes you have enough money coming in to make your basic payments, plus a little bit extra. If you’re in a situation in which you truly do not have enough money to pay your bills, this article will be more appropriate. As well, keep in mind there are some scenarios in which paying off debt is actually not your best option.

I have personally used this technique to attack debt, with a few tweaks of my own.

Here’s a more detailed explanation of how the Snowball Method works.

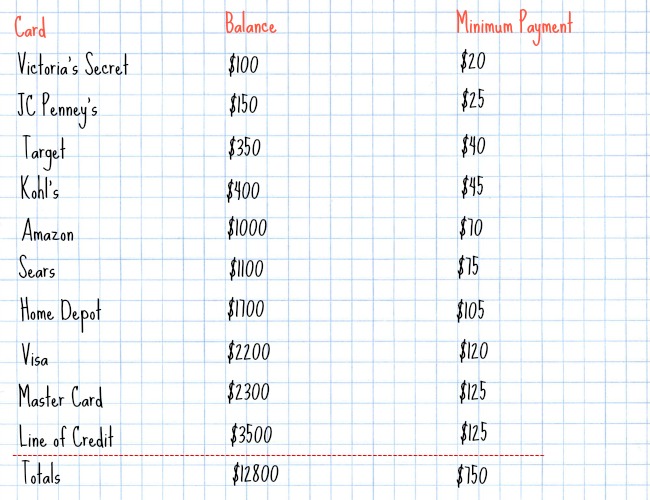

1.) Write down every penny you owe. This is tough love, and it’s painful, but go through all your bills and write down your totals. Most people find that the total is higher than they expected. The good news is, if you are truly committed to paying off your debt, this is the highest that it will be.

2.) Organize the bills from smallest to largest amounts. This may not seem like it makes much sense, but trust me…there’s a method to the madness here.

3.) Write another list of the minimum payments for each bill. This is your baseline of payments each month. For the sake of ease, let’s say there are ten bills with a total of $750 in monthly minimum payments.

4.) Now, figure out the rest of your budget. Once you pay your rent/mortgage, buy groceries, and pay the utility bills, how much money do you have on top of your $750 a month? For this exercise, we’ll say you have an extra hundred dollars.

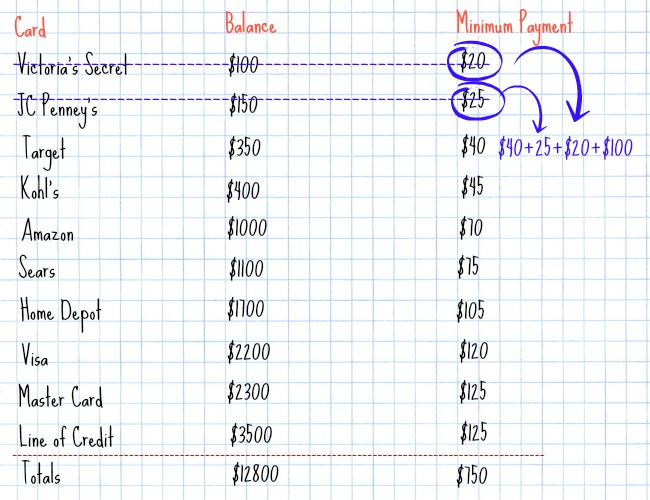

5.) Your worksheet might look something like this:

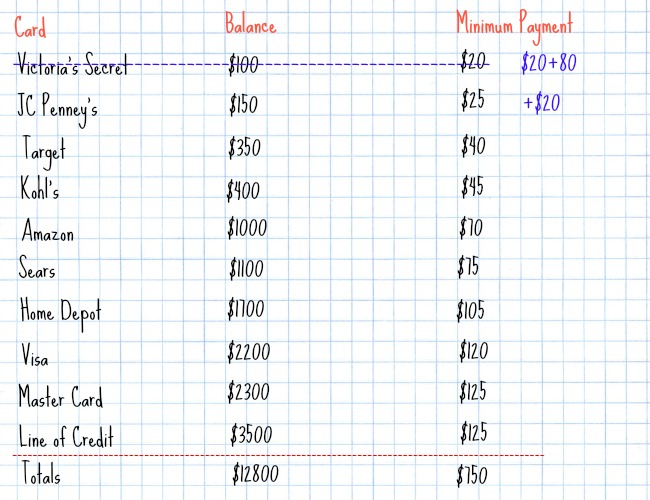

6.) Now, you’re going to start putting all of your extra money on the lowest bill each month. So, the first month, you make all of your minimum payments, put $80 extra on the Victoria’s Secret bill to pay it off, and then apply your leftover $20 to the JC Penney’s bill.

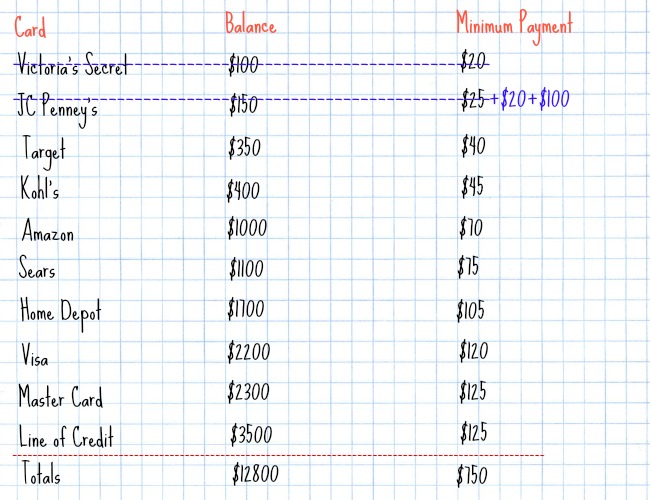

7.) The following month, take the minimum payment from Victoria’s Secret, the minimum from JC Penney’s, and your extra $100 to pay off your JC Penney’s debt. Keep in mind that due to interest, your other debts will not change much at all if you are only making the minimum payment. For the sake of this exercise, we’re living them as they are to demonstrate that.

8.) The month after that, you’ll combine all of your previous minimum payments with your extra hundred dollars, plus the minimum for Target for a total of $185 against that bill. It will take you two months of snowballing to pay this off.

And that’s how you pay off consumer debt quickly.

Do you get the idea? Instead of flailing away with minimum payments and a little extra when you can, make a concrete plan to take down debt as fast as possible. It can feel strange to only make minimum payments on the larger debts, but trust me, this is much more efficient than just paying a little extra here and there. If you get new windfalls while you’re paying off debt, like tax returns or bonuses, apply them to your smallest bills.

It can happen to anyone.

Sometimes we get into debt due to bad decisions and sometimes it’s out of desperation. If you have ever been without money for groceries or utilities, you may have used a credit card even though you knew it wasn’t a good idea. Maybe you had a great income when you incurred the debt but then lost your job. There are many reasons you could find yourself way over your head.

That’s all in the past. Don’t beat yourself up, because that’s ultimately counterproductive. Just commit to getting out of debt as quickly as you can and do your best to avoid the same pitfall in the future.

3 thoughts on “How to Use the Snowball Method to Get Out of Debt FAST”

I have used this before and it is great 🙂

Also for the really large debts, it is worth seeing if you can consolidate them at a lower interest rate. Or once you clear several of the smaller debts go to work on the large debt that has the highest interest rate. Interest rates of over 20% are a killer

Dave Ramsey’s “Snowball Method” is explained in his 2003 book “The Total Money Makeover…” in chapter 7 that begins on page 109. (I bought my copy for 50¢ at my local thrift store.) There is a long running difference of perspective from the people who realize that paying off the bills (starting with the highest interest rate bills first) will in the long run result in a somewhat lower total payout. They regard that lower total payout as a more motivating goal than Dave Ramsey’s emotional boost from early payoffs of the smallest bills first.

So as long as you understand that difference, make your choice. Are you better motivated to follow through by that early emotional boost or by the long term lower total payout? Some might argue that this is a difference between emotional decision makers and analytical decision makers. I think it’s more complex than that. I think as long as a person is self-aware of those sometimes conflicting internal perspectives, s/he is in the best position to make the most personally useful choice.

Some other issues that the snowball method does not address might include humongous sized bills that you can never ever pay off in your lifetime, fraudulent or double billing content in such bills, the element of being kidnapped into a situation where such large bills are forced onto you involuntarily, bill collectors who plead with you to make at least some seemingly small payments on a regular basis (without disclosing that every such payment, no matter how fraudulent the bill might have been, restarts from zero the statute of limitations clock per your state’s debt collection laws … to keep you from timing out such a debt). In my state that statute of limitations is 4 years which if no payments have been made in that time, the debt collectors (who may have bought such debt for pennies on the dollar) can no longer pursue you for that bill. For people who may have already filed bankruptcy over previous unrelated events (which presents them with a 7-year wait before they could file again), such a war with debt collectors over fraudulent, erroneous and/o or involuntary debts can leave such people with some brutal choices.

There is also an entire body of knowledge about how to structure one’s assets well in advance so that in the event of a court fight, those assets would be out of reach if a court judgment was created against your holdings, but that’s way beyond the scope of today’s discussion, and way past making a choice of a lowest bill first type of snowball versus a highest interest rate bill first version of snowballing.

–Lewis

Dave also recommends cutting up all your credit cards so that you don’t keep adding to the debt while you’re trying to pay it off. I think that’s a little extreme since I’d want credit available for a true emergency, and so keep one card.

Once I got out of debt except for the mortgage, I started running most of my expenses each month through that card (to get the rewards the card offers, and to float my debt for a month at no cost) and then I pay the balance *in full* each and every month.

Once I got to the point of being able to do that, I started making extra monthly payments to pay down the mortgage principal. Saves tens of thousands in mortgage interest. (Dave has a mortgage payoff calculator on his website.)